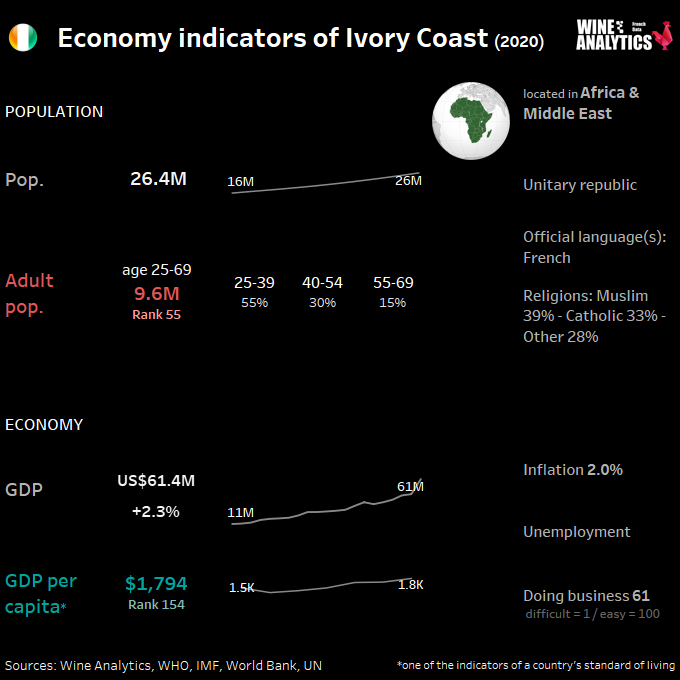

Côte d’Ivoire is the largest economy in French-speaking Africa, with growth rates averaging 7.5% since 2012. Over the same period, real GDP per capita has increased by 32%. The Ivorian economy is also the most diversified in the region. This dynamism, combined with quality infrastructure and a favorable business environment, gives the Ivory Coast a position as a regional hub that makes it a preferred destination for all companies wishing to develop their activities in West Africa.

RATE THE IVORIAN WINE MARKET ATTRACTIVENESS

In 2018, Ivory Coast boasted a strong 7.8% real GDP growth rate, following several years of consistent expansion. The country also experienced increased productivity, household consumption, and real income. In part, this progress stems from a young, burgeoning population, of which 59.5% are under the age of 25. Still in its early development stages, Ivory Coast depends heavily on its agricultural sector for food production and economic growth. As the world’s largest supplier of cocoa beans, Ivory Coast is extremely vulnerable to international price volatility, along with having the fluctuating CFA Franc as its currency. Ivory Coast imported $1.9 billion of agricultural goods last year, with the EU, China, India, and Thailand as its largest suppliers.

Read also Ghana Wine Market Shows Growth

Beer remains the most consumed beverage

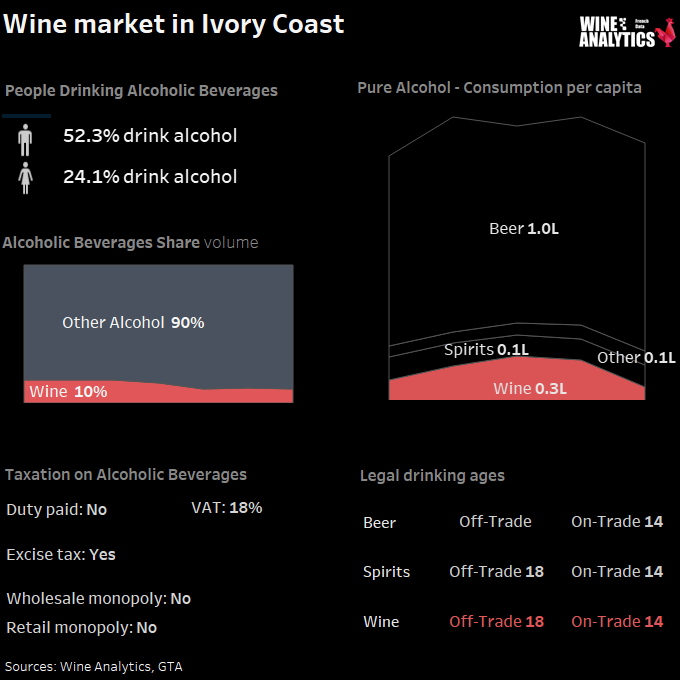

The Ivory Coast’s market for alcoholic beverages is steadily expanding. Beer remains the most consumed alcoholic beverage with 22.6 liters per capita due to high production. 3.2 M hl share the market, including the Castel subsidiary, Solibra and Brassivooire, a joint venture formed by Heineken and CFAO. Wine imports totaled nearly $51 million in 2018, and another $13 million in malt beer imports, with the EU as the leading supplier. The brewery players offer competitive prices (EUR 0.76) with brands that appeal to the consumer with the image of associated stars (the footballer Drogba) or the recognition of the country “bière Ivoire”.

The consumption of spirits remains low and less in the cultural habits. Distilled spirit imports also increased between 2014 to 2018, from approximately $7 million to $21.8 million. Consumers seem largely inclined to liqueurs and whiskeys.

Demand for Western spirits and other alcoholic drinks appears favorable for new exporters thanks to increases in disposable household income. The artisanal production based on palm heart called “Koutoukou” has a high consumption and is accessible to the average consumer.

Ivorians prefer to see the products they buy

The on-trade channel is mainly supplied by wine and spirits importers. The hotel sector is expanding and new projects are being announced in response to the country’s strong economic growth.

Carrefour stores are supplied with wine via the CFAO Retail purchasing center in France.

More and more players are launching into wine distribution with a real policy of accompanying the product by highlighting the region of origin and the marketing to be integrated for the promotion of the various brands offered.

Online sales are not part of the consumption habits of Ivorians who prefer to travel to see the products they buy.

Wine consumption is more of a male affair, hence a marked tendency to drink red wine because of the spicy food in the Ivory Coast. A middle class that recognizes and appreciates quality wines and likes to distinguish itself by expensive and unusual products.

French wines appreciated for their quality

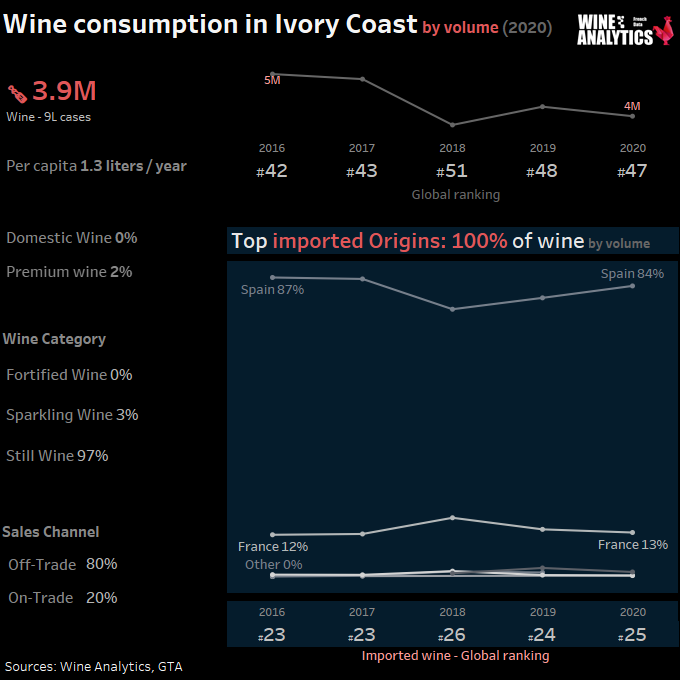

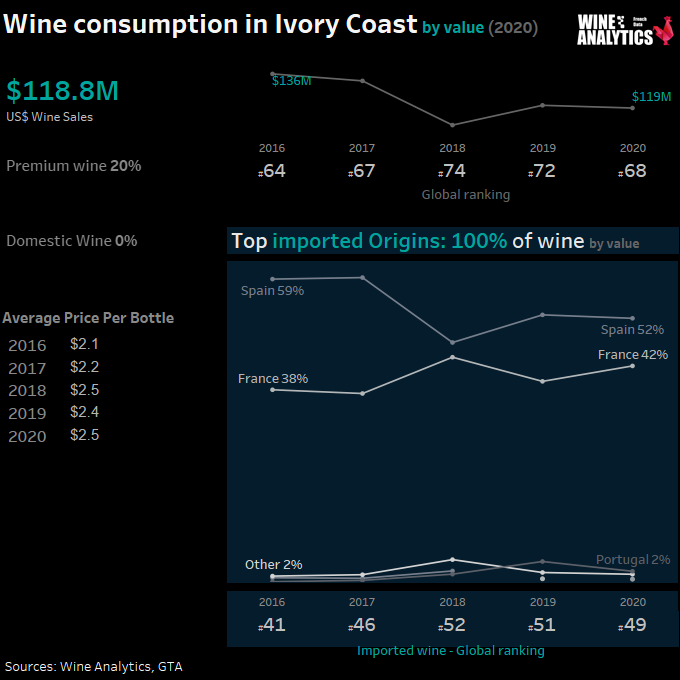

Spanish wines remain leaders with 16.8M EUR ahead of France, but they have experienced a decline compared to 2019 (-13%) due to the low consumption of first price wines on which Spanish origin wines are aligned. There is also bulk bottling by 2 players, the 3rd was bought by Solibra.

France is in second place (EUR 11.2 million) but stands out for the quality of its products, which are highly appreciated and recognized by consumers. The Ivory Coast remains a great consumer of wines, especially Bordeaux, the first region present on the Ivorian soil. Premium wines experienced a boom during the COVID-19 pandemic in contrast to the first price wines. Some regions (Rhone Valley, Languedoc-Roussillon, South West) have recorded a strong increase x 5 compared to 2019. Wines from new regions such as Provence are positioning themselves on the Ivorian market.

The actor Pernod Ricard is present on the spot to boost its sales although in partnership with the leader of the food distribution Prosuma through its subsidiary Oenophile.

Do not choose the leading importer

Aiming at leading importers is not the key to success. They are already very solicited, your products may be positioned second on the shelf. It is better to choose the one who will follow and invest in the promotion of your wines and spirits.

The visit of a high ranking official (e.g. a Director) is very appreciated and shows confidence, a determining factor in business. Allocating a communication budget is very important, as well as sending samples and goodies to maintain business relations.

It is necessary to count on a minimum of two trips in the year, or even more, to accompany and boost sales, especially if the partner buys from several suppliers.