Italy is the 3rd largest economy in the Eurozone after Germany and France. Affected by diminished disposable incomes and high unemployment, Italian consumers remain very price conscious and tend to seek discounts. Italians have always been value-seekers, looking for quality over price and discounts.

RATE THE ITALIAN WINE MARKET ATTRACTIVENESS

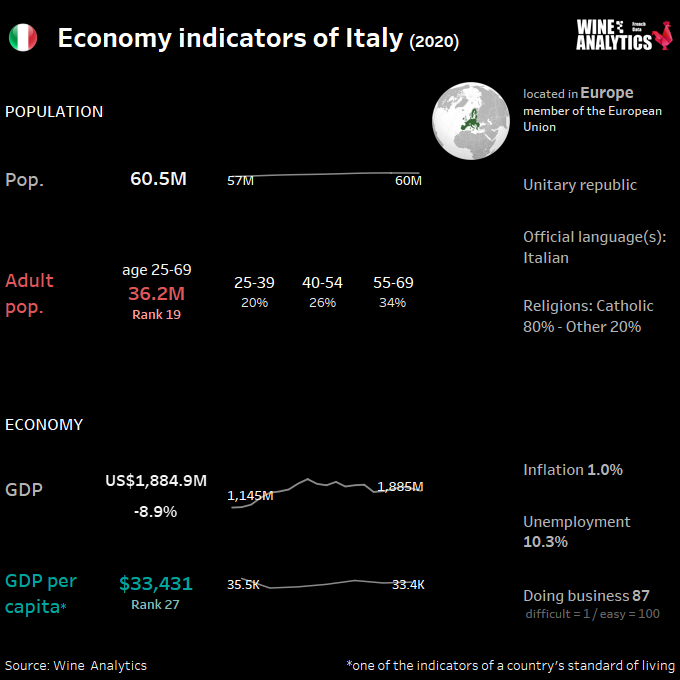

Italy has a diversified industrial economy, divided into a developed industrial north and a less-developed agricultural south, with high unemployment. The Italian economy is driven in large part by the manufacture of high-quality consumer goods produced by small and medium-sized enterprises, many of them family owned. Italy is the third-largest economy in the euro-zone, but exceptionally high public debt burdens and structural impediments to growth have rendered it vulnerable to scrutiny by financial markets. Italy’s GDP is estimated at $1.885 trillion, and it has a per capita GDP of $33,500. Italy has few natural resources, with much land unsuited for farming. It is a net agricultural importer.

Read also Czech Republic, a market for white wine

Strong regional disparities:

- North West: around Milan, Turin and Genoa, characterized by a strong industrial presence and a very high GDP per capita.

- North East: very dynamic region with historical industrial SMEs that are resisting well to the crisis.

- Center: industry and tourism are strongly developed.

- South and islands: marked by the presence of very small businesses and agri-food industries that suffer from the lack of infrastructure and the presence of a large and the presence of an important underground economy.

The retail sector is important

Food retailing in Italy is extremely important, given that consumers place food in a prominent position on their scale of values and needs. Italian consumer interest in local, organic and healthier food has encouraged grocery retailers to increase their product range by adding more locally-produced packaged food, as well as branded items.

Italy’s food distribution system has noticeable differences in terms of sector growth between the north and south. Italy’s diversified industrial economy is divided by a developed industrial north dominated by private companies, and a less-developed agricultural south afflicted with high unemployment. This division in reflected in the distribution of retail outlets, with the majority of the supermarkets located in the north (53%), followed by the south (27%) and then by the central region of Italy (20%).

While small neighborhood shops and specialty stores are still the norm, Italian consumers are discovering the convenience of large supermarket and hypermarket outlets.

Larger supermarket and hypermarket stores are introducing private label brands. Italian consumer purchasing habits place great value on the freshness and quality of products, therefore shopping several times a week versus other European countries where consumer patterns show a greater tendency towards once a weekly bulk purchasing.

| Leading Players | Sales in 2016 |

| Coop Italia | €12.4 billion |

| Conad | €12.0 billion |

| Esselunga | €7.0 billion |

| SIGMA | €6.0 billion |

| CRAI | €4.8 billion |

| Carrefour | €4.7 billion |

| Despar | €3.1 billion |

| LIDL | €3.0 billion |

| SISA | €2.5 billion |

| Auchan | n/a |

Italy is a great agricultural country and its food industry enjoys a great international reputation. Italians are still gourmets, and the pleasures of the table are strongly rooted in their culture. Thus, even in times of crisis, households continue to look for quality products for their daily consumption.

Alcohol: quality and low-alcohol beverages

Consumption of alcoholic beverages is decreasing but is moving towards quality products with a higher positioning and also towards products with a lower alcohol content, particularly as an aperitif, where low-alcohol beverages and sparkling wines are increasing.

The spirits market is estimated at 110.3M liters in 2020, down 20.3% for a total of EUR 6 billion (32.7%), with respective shares of the on-trade and off-trade channels being 41% and 59%. Rums, lemon liqueurs, whiskies, vodkas, vermouth and aniseed-flavored spirits are the other most consumed spirits.

The beer market amounted to 15.2M hectoliters in 2020 with an average consumption of 29.1 l/capita.

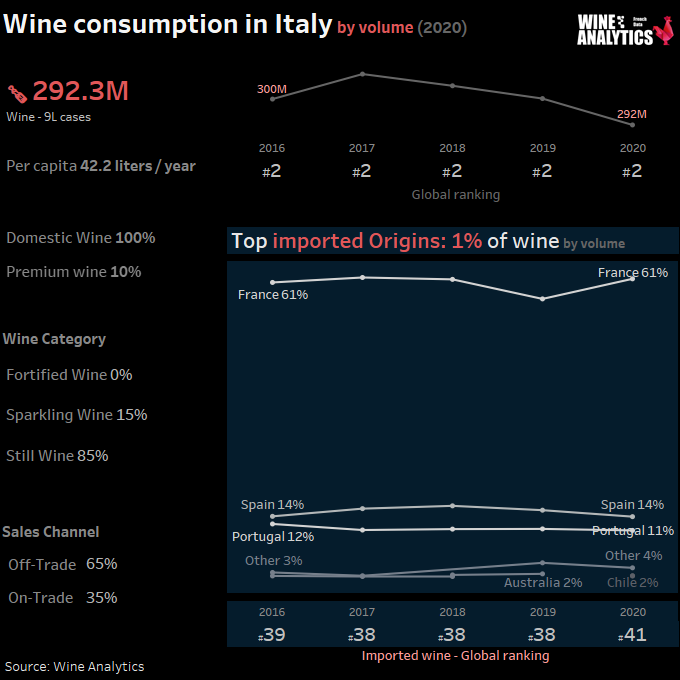

Italy is the 3rd largest consumer of wine after the United States and France, its market is estimated at 22.5M hectoliters in 2020 for a total of 12.9 billion EUR (15.8%).

Domestic wines dominate, with a mainly regional offer

The consumption of wine is becoming more demanding, associated with an increasing attention to production methods but also to the design and communication of the producer. Consumers are more attentive to the quality and uniqueness of the products they consume, as well as the production methods used.

Wine consumption in Italy has been declining for decades. Causes for the trend include changing lifestyles and tastes, as well as anti-alcohol marketing campaigns. Per capita wine consumption is estimated at less than 33 liters for 2017, considerably lower than 45 liters in 2007 and 110 liters in the 70s. Recent wine consumer surveys show that Italian origin and familiarity with the winery are the main elements in determining consumer choice. Despite economic austerity measures, Italian wine consumers are seeking higher quality wines, but still in the modest price range.

Organic and biodynamic wines meet the approval of a growing number of consumers wishing to orient their choices towards wines from sustainable production methods. This trend has been exacerbated by the pandemic, placing health and well-being at the forefront. Consumption of organic wine continues to grow: in the first 10 months of 2020, sales of organic wines increased by 12.5% in volume in supermarkets. The share of organic wines in total sales is increasing every year.

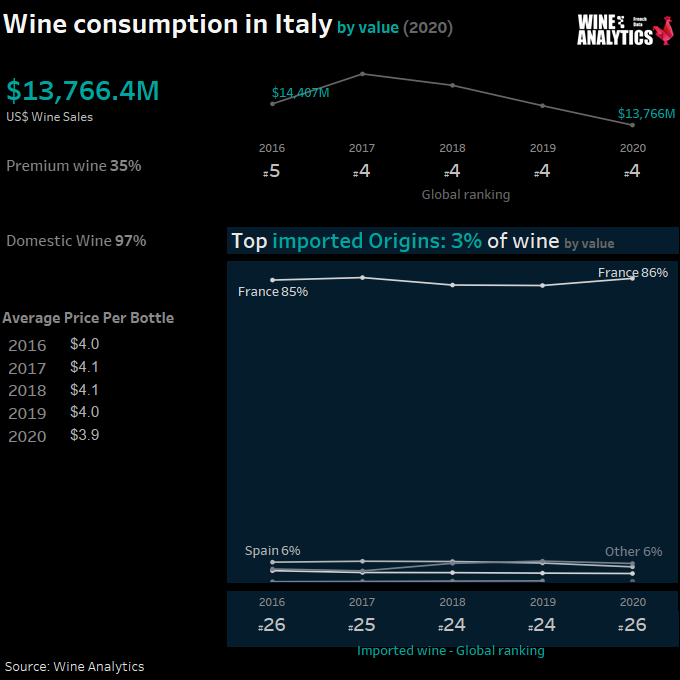

France and Spain have developed a long-standing reputation in the market and are price competitive. The quality and specificity of French wine appellations are recognized and appreciated In terms of value, France remains the benchmark for imported wines, far ahead of competing countries.

Champagne is benefiting from the dynamics of the On Trade in Italy, after a winter and early spring marked by restrictions limiting the activity of the on-trade Italy is a market where, for Champagne, the prestige and vintage brut cuvées are well valued and appreciated by consumers This search for excellence by wine lovers is also true for still PDO wines.

The quality and specificity of the great French appellations are recognized France remains the unavoidable reference for imported bottled wines, far ahead of competing countries.

In 2020, the on-trade sector accounted for 21% of sales in volume and 39.5% in value and, for the off-trade channel , wine shops hold a 12.3% share of the market. The offer in supermarkets is very wide. Domestic wines dominate, with a mainly regional and local offer.

The share of the on-trade channel in alcoholic beverage sales has decreased in 2020 due to the restrictions applied since the beginning of the pandemic.

Online wine sales have literally exploded, with an increase of +435% for pure players platforms and +74.9 for producers’ DTC websites.

Italian importers are usually small to medium-sized companies

The best way to begin exporting to Italy is to either identify a key importer, broker, distributor, agent or wholesaler as they know how to best navigate the import and distribution process and are able to engage directly with Italian food retailers. They are key to doing business in Italy. Food importing is a specialized business, and an importer plays a pivotal role in navigating the hurdles of Italian and EU food law. Importers normally carry a whole range of products.

Italian importers are usually small to medium-sized companies, rather than the large, market-dominating varieties found in northern Europe. Consequently, these companies import on a smaller scale, but often a broader range of products than their much larger counterparts.

Be prepared to start small by shipping a few pallets or cases of a product and recognize that it could take several months or years before an importer is ready to order full containers. Italians place a lot of importance on first building the trust to consolidate the business relationship.

The relationship is essential, the Italians need to meet the producer and build a strong interpersonal relationship. It is essential to go to Italy once or twice a year to meet your business partner and demonstrate your willingness to support them through customer visits and tasting sessions.