According to Japan National Tax Agency data*, consumption of wine is up over the last decade, along with whiskey and liquors, while the consumption of beer, Happoshu, Shochu, and Sake have all fallen.

RATE THE JAPANESE WINE MARKET ATTRACTIVENESS

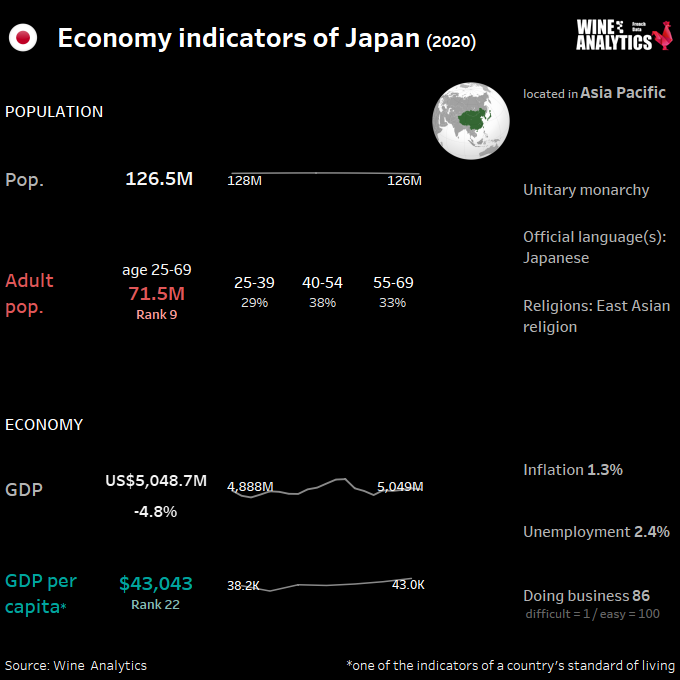

As the world’s third largest economy, Japan remains a major partner for France in Asia. It has a mature and sophisticated market that benefits many French brands in the luxury, fashion and gastronomy sectors. It is also a country spearheading innovation and new services, where companies with know-how and technologies to be developed in industry, transport, health and digital technology can establish business relationships.

Without natural resources and to better resist competition with China and other emerging countries, Japan invests heavily in innovation (12.6% of global R&D spending in 2018 for 1.6% of the world’s population) and bases its export power around high value-added sectors (machinery, electronics, etc.).

Read also Vietnam, the next wine hub for Southeast Asia?

Approaching 240 of GDP in 2019, Japan’s public debt is one of the highest in the world. However, the country is not threatened by a risk of sovereign default and remains well rated by the rating agencies: more than 90% of its debt is held by Japanese creditors (notably financial institutions), which allows it to benefit from very low rates.

Beer, the most consumed beverage

Beer is the most consumed alcoholic beverage in Japan (by volume). Considering that at the same time the number of microbrewers has never been so high in Japan 368 in 2018 they were 196 in 2008 it is likely that France struggles to demonstrate a specific advantage on the local market, France being otherwise resolutely associated with wine.

France has been struggling for years, its fruit brandy/raisin type spirits lacking impact in an extremely competitive market. However, French whisky, undoubtedly surfing on the novelty and the local shortage (Japanese whisky has become a sought-after product worldwide), is making very interesting progress.

Young People Reject Traditional Drinks

The market for French wines and spirits in Japan is substantial. Japan has a broad base of wine connoisseurs who began learning to enjoy wine in the 1980’s and 90’s. They are now a large part of the older population with considerable disposable income to purchase wines. As Japan’s population ages, the market for high quality wines increased.

Globally, young people are rejecting traditional drinks in favor of newer and lighter varieties. However, individuals in their 20’s have a decreasing interest in the “drinking culture” which greatly influences overall alcohol consumption in Japan. Ready-to-Drink (RTD) can be purchased in convenient stores and cater to the younger generation. A couple of examples are canned Chu-hi (fruit cocktail) and Highball (whiskey with soda).

According to the research conducted in 2016, only 15% of Japanese women regularly drink any kind of alcohol, as opposed to over 40% of men. However, the person who decides which wine to drink tends to be female.

Japan wines are becoming more visible in retail stores and some restaurants, as consumers appreciate domestic production and view Japan wine as high quality. Wine that contains only domestic ingredients can be classified and labeled as a “Japan Wine”.

In 2019 the Economic Partnership Agreement between the European Union and Japan came into force. It eliminated customs duties on wines.

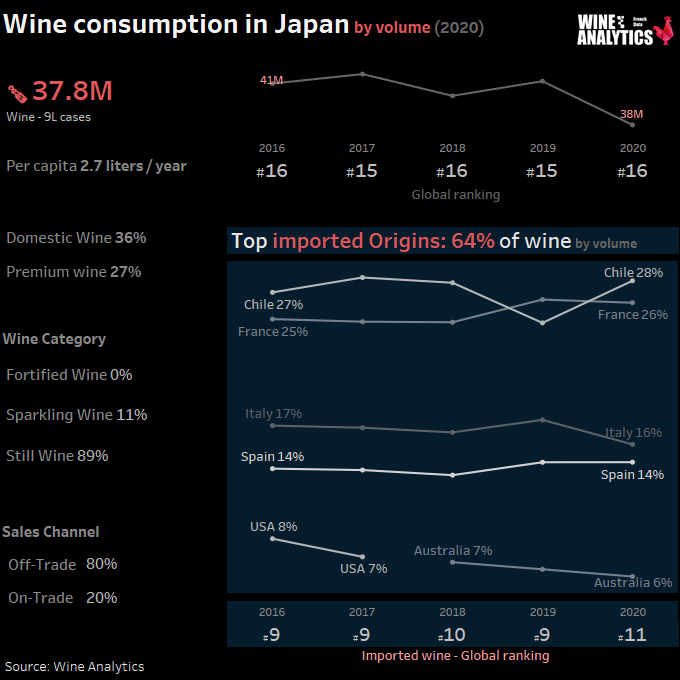

Strong Image of French Wines

The 5 main countries supplying wine to Japan in volume are, in decreasing order, Chile, France, Italy, Spain and Australia. While this ranking remains pretty much unchanged, 2019 has nevertheless seen a real shake-up in the market although Chilean wines maintain their position as the top supplier by volume, they have recorded an unprecedented 7% drop in volume in 2019 attributed to renewed competition from European wines due to the EU Japan agreement coming into effect. This new opportunity has not escaped the attention of Japanese buyers, especially in supermarkets, where Chile had a strong presence. Wine consumers contrasts with English-speaking countries.

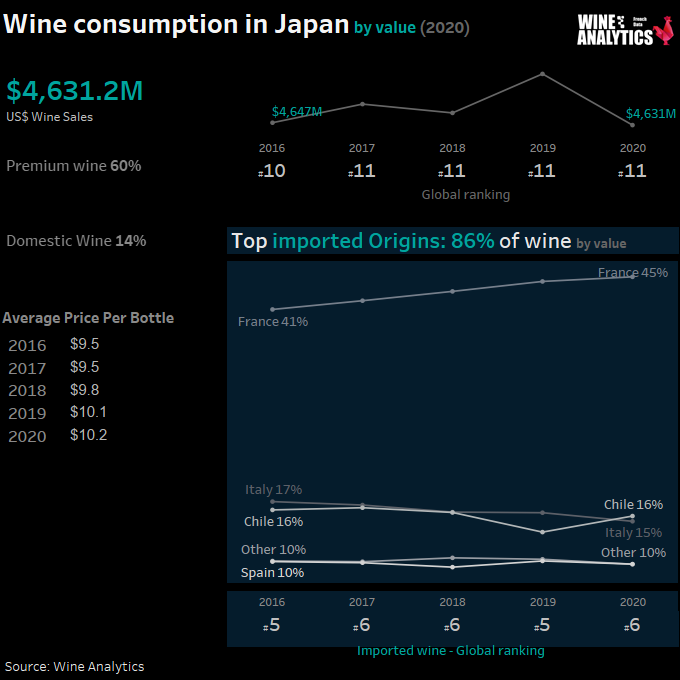

While France carries the strongest image for wine in Japan, its bottled wine market share continues to decline steadily due primarily to competition from new world wines. The older generation connoisseurs who learned about wine with French wines have a large influence on Japanese sommelier society. Industry experts, therefore, forecast that despite the shrinking market of French wine, demand in Japan will continue to be strong.

Napa Valley resonates well with Japanese consumers and it is now associated with high quality wine.

Unlike countries such as the United States (where most sales are made in supermarkets) or Chile (very strong presence in supermarkets), France has a natural inclination towards the on-trade network (32% of its sales).

France is the 1st supplier in value, with nearly 40% of the market share France’s positioning is decidedly mid to high-end, a problematic situation considering the long-term developments of the market 77% of the market is for wines sold under JPY 1,500. However, this represents a slight shift, as in 2018 they represented 79% of the market. The category of wines between 3,000 and 5,000 JPY recorded an increase of 23.1% (France +6%). It is still too early to speak of a revival of the mid-range but it is an encouraging trend for France.

Japan is a premium wine market for the United States, where U.S. wine brands are favored for their innovation, desirable flavor profile, sweetness, and high alcohol content. Napa Valley resonates well with Japanese consumers and it is now associated with high quality wine.

In general, European countries (Italy, Spain) are progressing at the expense of New World wines, although some manage to do well without the effect of the Trans-Pacific Partnership (TPP) being clear Chile and Australia, members of the TPP agreement, are seeing their exports fall. Conversely, New Zealand is progressing, but this is also the case of Argentina, which is not part of the TPP.

Chilean wine now dominates in the lower price segments, selling very well at supermarkets and convenience stores. Chile became the largest supplier on a quantity basis and second largest on a value basis Chile. Australian bottled wine imports have fallen from their peak in 2012, but have plateaued in recent years. Imports of bottled Italian decreased marginally in 2018. Spanish wines sell very well in convenience stores and supermarkets. Spanish wine is viewed favorably in the lower priced range.

Organic Wine: Japanese consumers are very health oriented. Organic and Biodynamic wines have attracted more attention in 2018.

French sparkling wines (mainly champagne but not only Crémant de Bourgogne) are in excellent shape, while their exports are up by 3.7% worldwide, they are up by 13.7% in Japan. Champagne has enjoyed almost uninterrupted growth for the past 10 years. While still wines have suffered greatly in recent years, between 2009 and 2019 the export volume of French sparkling wines to Japan, driven by champagne, has doubled and now reaches 1,829 billion cases. For still wines, almost all appellations, with the exception of Beaujolais, have benefited from the Bordeaux EPA of course, but also Alsace (+31.5%) and the Rhone (+10.8%). The big winner, however, seems to be the South West, which recorded an impressive increase in PDO (+46.2%) as well as in PGI (+51.7%). The good price positioning 3.7 EUR/L on average for South West PDO, against 8.0 EUR for Bordeaux and 20.7 EUR for Burgundy) probably facilitates this EPA-driven progression.

All levels of Restaurants list Wines

Both food service and retail consumption of wine are robust as many consumers show interest in wine as the market offers a wide price range and different wine varieties, especially in urban areas like Tokyo and Osaka.

Most retail stores such as supermarkets, convenience stores, discount stores shelve a variety of wines at different pricing levels, which attracts customers to their stores. Half bottles have recently stood out on shelve as well.

Even small size sushi restaurants will offer a few labels of wine.

Recently, supermarkets have expanded the variety of wine and liquor offerings, but supermarkets generally rely on importers for their product lineup.

Restaurants that offer premium wines are mostly French, Italian and Spanish restaurants. Today, all levels of restaurants have wine options. The pricing will depend on the quality of the restaurant. Even small size sushi restaurants will offer a few labels of wine. Low-cost chain restaurants will serve bag-in-box type wines.

Internet purchases of wines are growing in Japan.

A very different culture: a commercial challenge

There is a wide variety of importers in the field of wines: large brewers, large specialized importers, supermarkets, wine store chains, CHR importers, etc. It is essential that the offer corresponds to the demand of the network in a context of varied and complex distribution.

Unlike solid products, exclusivity is not a central problem because of the labels. On the other hand, having several importers in a country with a very different culture can become a commercial challenge.

On the other hand, having several importers in a country with a very different culture can become a commercial challenge. Without a full time export manager, or even a zone, and/or an agent, it is therefore preferable to choose the right partner for practical reasons.