Poland’s wine market, despite the COVID-19 pandemic, is expected to continue growing over the next five years. According to Polish Customs data, 2019 U.S. wine imports exceeded $34 million, accounting for over 10% of Poland’s total wine market.

RATE THE POLISH WINE MARKET ATTRACTIVENESS

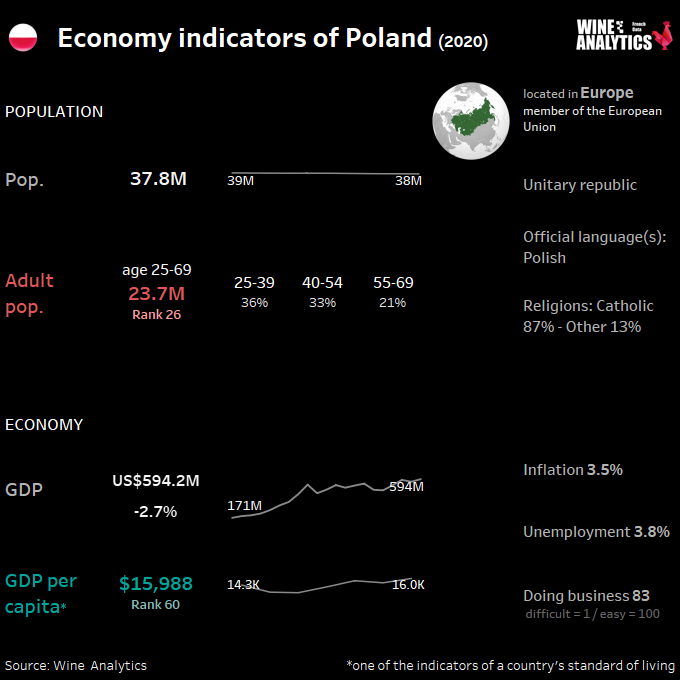

At the heart of Europe and the largest market in Central and Eastern Europe, Poland, a member of the European Union since 2004, has a robust economy.

The recession of 2009, Poland is also showing strong resilience in the face of the health crisis of 2020. Supported by domestic demand, foreign investment and European funds, the Polish economy benefits from a qualified workforce, moderate labor costs and will be the 4th largest beneficiary of the EU’s economic growth. and will be the 4th largest recipient of European Recovery Plan funds.

READ ALSO Belgium, a beer or wine market

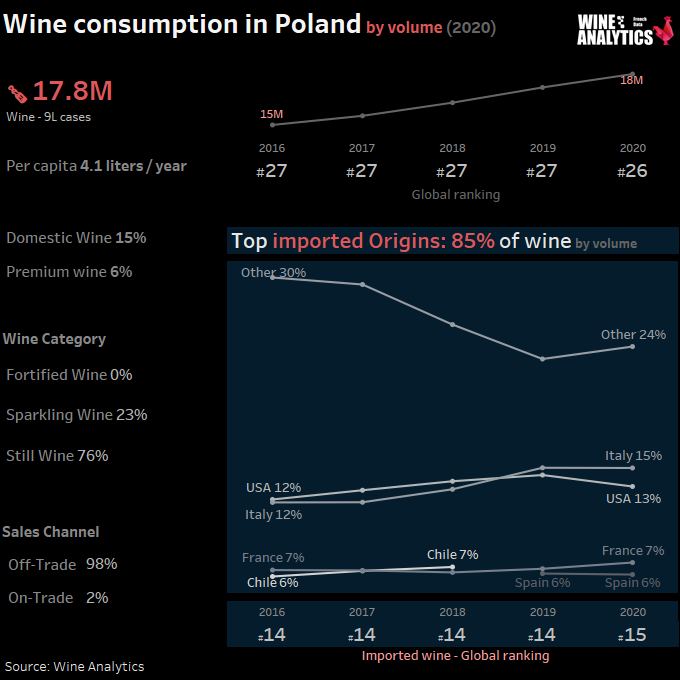

Polish wine consumption has steadily increased in recent years due to higher disposable incomes, easier access to higher quality products, and evolving consumer trends. Because Poland is a European Union (EU) Member State, Polish wine importers and distributors enjoy relatively easy access to wines available within the common market.

The growth in the purchasing power of Polish consumers and the evolution of consumption favor softer alcohols such as wine, beer and cider as well as the more sought-after such as wine, beer and cider as well as the more sought-after hard liquor.

Spirits still occupy a traditional place, with nearly a third of sales, however, the most consumed alcoholic beverage remains beer, with more than half of total sales. Since the 2000s the Polish wine market has been growing steadily. The market remains entirely dependent on imports.

Since the 2000s the Polish wine market has been growing steadily. The market remains entirely dependent on imports. The younger generation, who are mobile, are looking for new tastes and are driving the growth of the light, fruity, still and sparkling varietal wine segment.

Consumption mode: mainly outside of meals

Poles Prefer Red and Sweet Wines

EU accession fomented substantially more interest among Polish consumers for wine, as easy travel to other Member States exposure more people to more wine, further spread through word of mouth, and increased consumer interest in nontraditional Polish foods. Wine has also gained popularity through international television and the popularity of cooking shows.

Bulgaria and Moldova are historical suppliers whose wines are mainly inexpensive and on the Polish market are above all inexpensive and sweet. Italy and Spain are gaining market share year after year. This is due to several factors, including the popularity of Italian cuisine, tourism and good value for money. New World wines enjoy popularity in Poland due to their affordability and the concentration of taste that

preferences of Polish consumers.

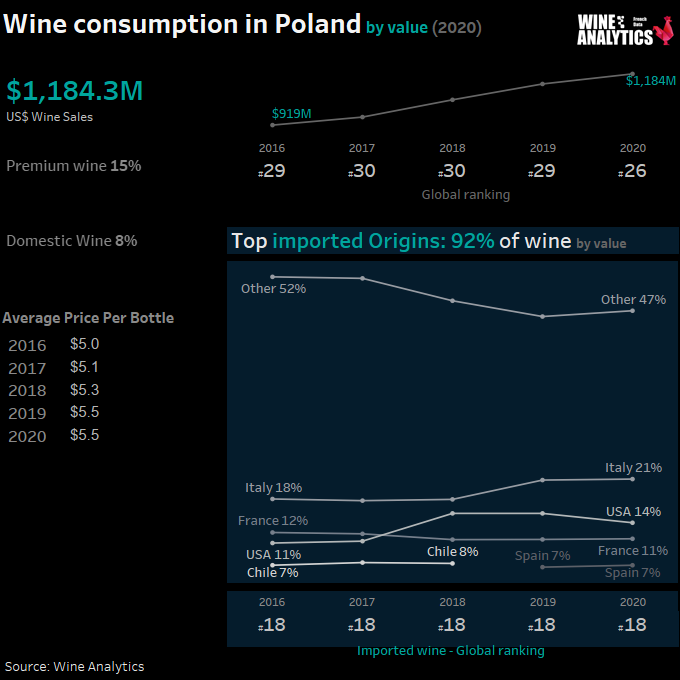

Poles generally prefer red wines followed by sweeter whites, although consumer preferences are slowly trending away from sweet wines toward drier white varietals. Sparkling wines like Prosecco and Cava are growing in popularity, followed by still rosés, and champagne. The Polish wine market is dominated by low-cost table wines, but higher quality wines have made inroads among many consumers. Increasingly serious marketing efforts, on-line wine sellers, and a proliferation of wine shops, particularly in leading shopping centers, have all contributed toward popularizing higher-end wines.

Although wine consumption is less seasonal than it was in the past, some seasonal trends persist. For example, sparkling wines, including champagne, are particularly popular during Christmas, New Years, Carnival in February, and during first communion season in May.

France is the 3rd largest supplier of wine in value and 4th in volume, behind Italy, Germany and the US.

French PDO wines are appreciated but are in strong competition with wines from the New World (especially varietal wines), with Italian PDO and varietal wines, as well as by Germany (especially for white wines).

Demand is clearly targeting the mid-range EUR 6 to 12: products offering a good quality/price ratio, wines sold in small convenience stores and specialized wine stores account for more than 30% of wine sales by volume.

The champagnes have been growing steadily since 2013. Competition from cava and prosecco is strong.

Wine Re-export from Germany

In 2019, total Polish wine imports were valued at $360 million. 2019 U.S. wine imports were valued at $34 million, a $10 million decrease from $44 million in 2018. Non-European wines are generally not shipped directly to Poland, but arrive through western EU intermediaries like Germany, where they arrive bottled or in barrels to be bottled.

The leading origins are Italy, Germany, France, and the US.

Most large importers distribute products through their own wholesale operations located throughout Poland. Besides utilizing their own distribution channels, importers also sell their products to independent wholesale firms, which in turn distribute wine to hypermarkets, specialty shops, and small retail stores located in larger cities.

Largest retail store chains import wines for their own distribution or obtain it from a local importer or wholesaler. By some estimates, there are as many as 700 Polish wine importers. Beyond the leading top 50 companies, these importers tend to be small and informal operations and there is little reliable data exists for this market segment.

Hard discounters, such as Jeronimo Martins (Biedronka) and Lidl, have considerably increased their presence on the wine market (30% market share) carrying out extensive marketing campaigns, accompanied by country weeks throughout the year. Biedronka’s purchases are made directly from Poland. Lidl relies on its central purchasing office as do all the other supermarket chains present in Poland (Carrefour, E.Leclerc, Auchan).

Market Promotion Constraints

Direct alcoholic beverage promotions in hypermarkets and specialty shops are prohibited. Importers and wholesalers can actively promote their products in restaurants and hotels, at wine tastings, and through professional periodicals available through subscriptions.

The wine choices of Polish drinkers are strongly influenced by promotional activities, such as sales promotions within popular wine buying channels or informative events. Wine in Poland is commonly marketed through targeted trade events, where organizers work with sommeliers and selected audience.

Entry Level price

While most wine consumed in Poland are lower-cost, market share for higher end wines is growing. However, most households remain unwilling to spend more than $15 on a bottle of wine purchased from a hyper/supermarket for home consumption, and are more likely to spend in the $5 to $10 range.

Retail prices for wine vary by varietal, region, country of origin, and perceived quality, which is correlated with the other price determining factors. Store formatting can also determine the retail price for a bottle of wine. Specialty wine stores offer customers more information about wines and often charge a premium over hyper/supermarkets.

Total off-trade consumption increased by 13% in value during 2020, however, imported wines grew at a faster rate than domestic wines, 16% and 12% respectively. The source countries driving the growth in import off-trade sales are Italy, France, and New Zealand.

2500 wine importers and distributors

The network of wine importers and distributors in Poland is highly fragmented and is made up of professionals of very different sizes, very much oriented towards regional and private customers. Among more than 2,500 companies specialized in the field, holding a compulsory license, the main players are Ambra Group, CEDC International and Bartex Bartol.

Poles are value-oriented and expect courtesy and punctuality from their business partners. The language skills of Poles are rather uneven, with the younger generation having a better command of English than the older generation who are more comfortable with German and Russian.

In this highly competitive environment, importers and distributors need the support of producers to be able to convince the consumer with promotional material, communication budget, etc.